Have you ever paused to consider what a financial analyst actually does, or perhaps wondered if this challenging yet rewarding career path is right for you? This comprehensive article dives deep into the world of financial analysis, unraveling the core responsibilities, diverse workplaces, essential skills, and significant impact these professionals have across various industries. We explore the who, what, when, where, why, and how of a financial analysts daily life, offering insights into their critical role in shaping business decisions and guiding investment strategies. From forecasting market trends to evaluating company performance, you will discover the intricate work that underpins successful financial outcomes. Get ready to explore the exciting possibilities and understand the vital contributions of financial analysts in todays dynamic economic landscape, providing a clear roadmap for anyone curious about this essential profession and its growing demand.

Ever wonder what a financial analyst actually does, truly, beyond the fancy titles and often intense market discussions? You might ask, who are these professionals, what exactly is their daily grind, when do they typically operate within the market cycles, where do their insights find application, why is their work so incredibly vital, and how do they manage to make sense of complex financial data? Financial analysts are the insightful navigators of the economic seas, working to interpret vast amounts of financial information to help individuals, companies, and governments make smart money decisions. They are the detectives of the financial world, constantly sifting through reports, market data, and economic indicators to uncover valuable insights and future trends. Their roles are incredibly diverse, stretching across various sectors from investment banking to corporate finance, and their influence directly impacts everything from your personal investments to the strategic direction of multinational corporations, making their understanding of financial markets and economic principles indispensable for sustainable growth and informed decision-making in our interconnected global economy, guiding the flow of capital and the strategies that shape our financial futures.

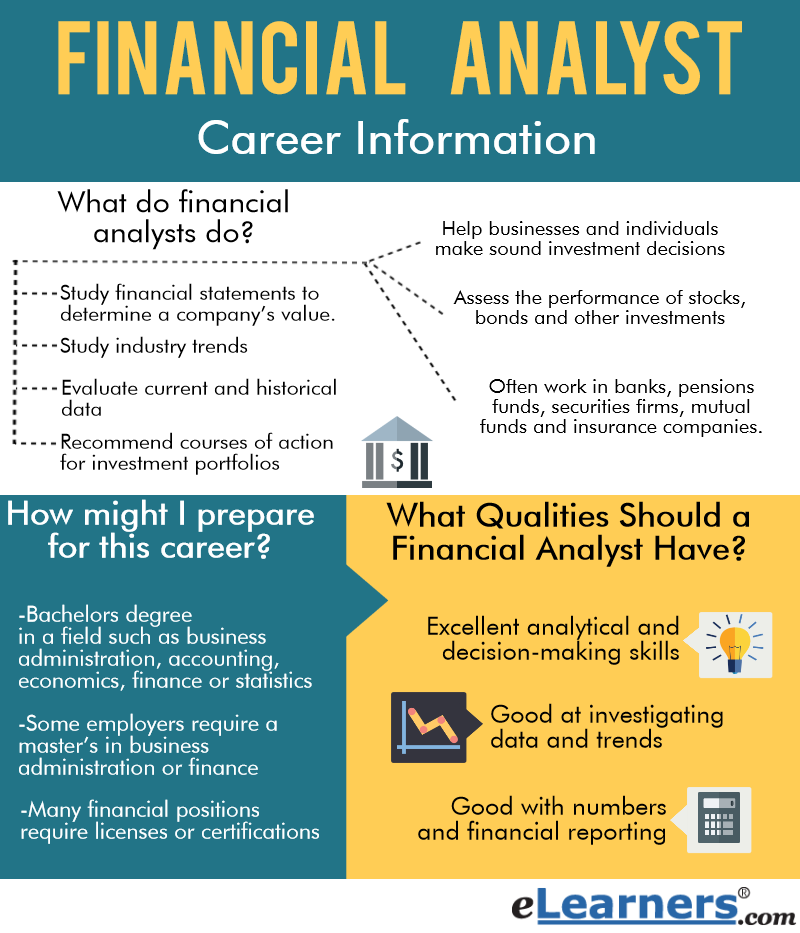

What Does a Financial Analyst Do? Understanding the Core Role

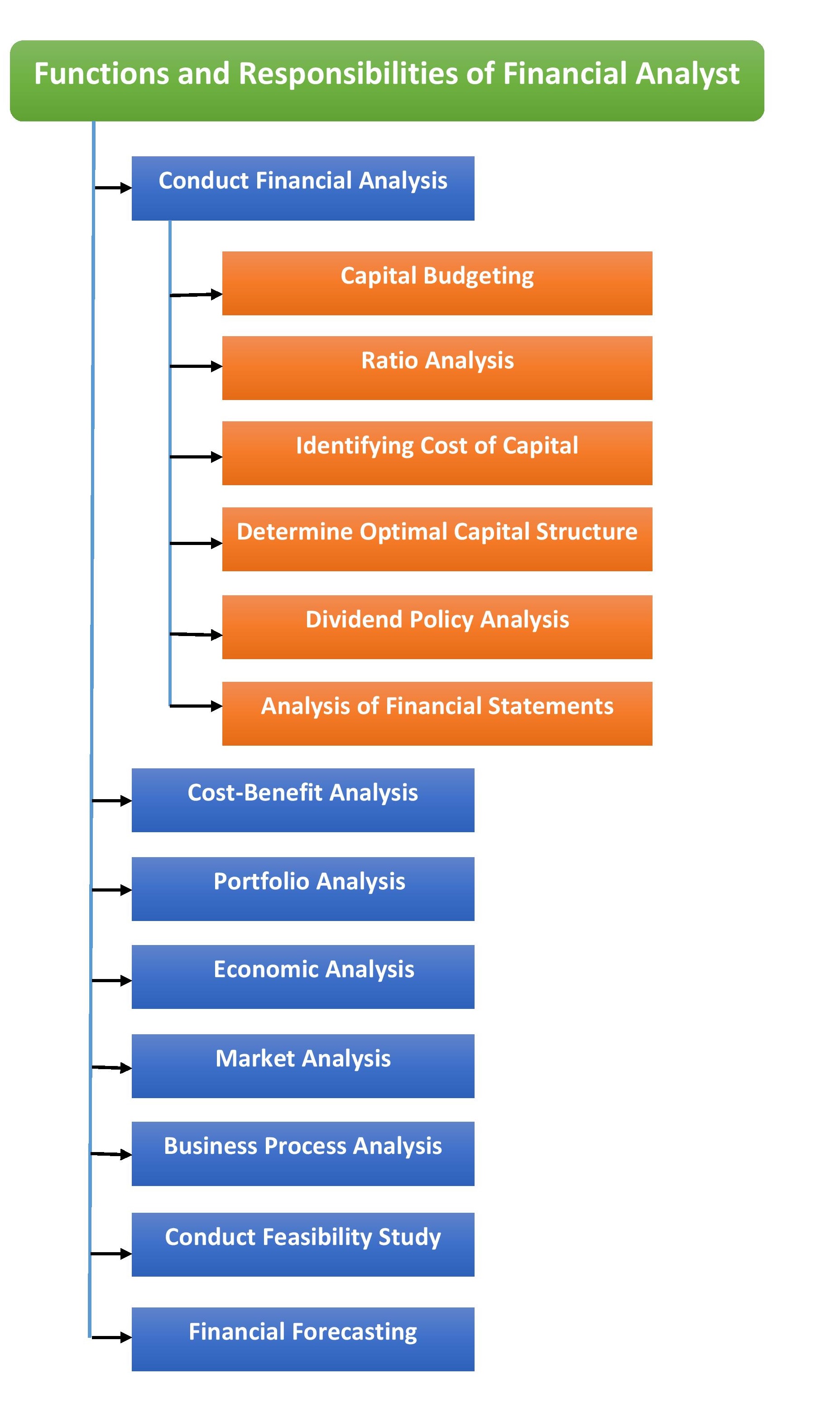

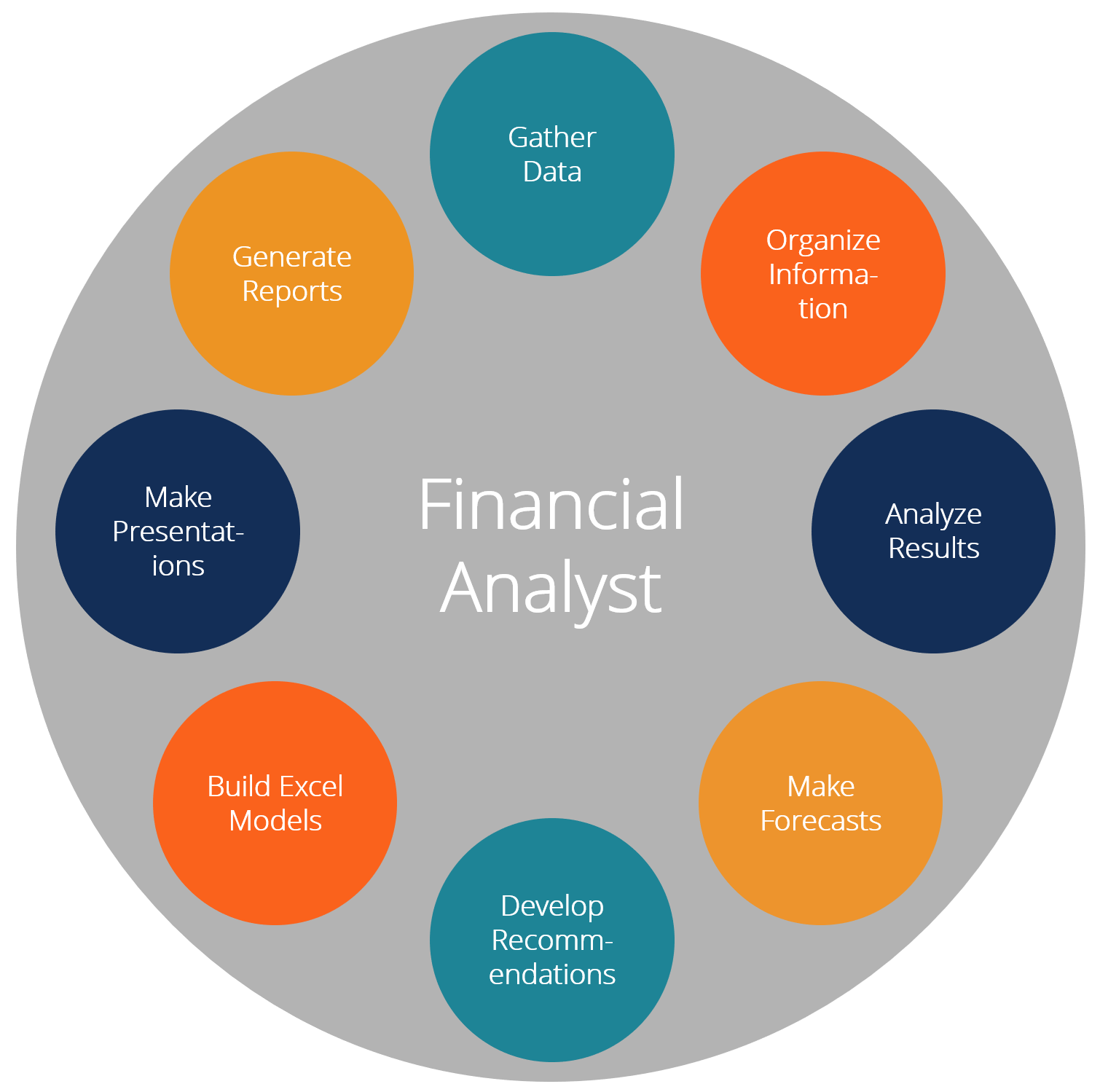

So, what exactly is the core function when we talk about what does a financial analyst do? At its heart, a financial analyst takes complex financial data and transforms it into understandable, actionable insights. What does this mean in practical terms? They spend significant time analyzing financial statements, market trends, and economic conditions to recommend investment strategies or evaluate business performance. Why is this critical? Because businesses and investors need reliable information to make confident choices about where to allocate capital, whether it is for buying stocks, funding a new project, or deciding on a company acquisition. How do they achieve this? They build sophisticated financial models, perform valuation analysis, and write detailed reports that explain their findings and recommendations clearly. When do these activities happen? Continuously, as markets evolve daily, requiring constant monitoring and re-evaluation of assumptions. Where do these skills become most valuable? In boardrooms, trading floors, and investor meetings, where big decisions are on the line, emphasizing their pivotal role in guiding financial success and mitigating potential risks, ensuring that every financial move is backed by thorough research and expert analysis, leading to more robust and resilient economic outcomes for all stakeholders involved.

Deconstructing the Daily Grind: Key Tasks for a Financial Analyst

Let us peel back another layer and explore the typical tasks and responsibilities that fill a financial analysts workday, understanding what does a financial analyst do from a practical standpoint. Who performs these tasks? Analysts at all levels, from entry-level associates to seasoned portfolio managers, engage in these activities. What are these tasks? They range from meticulous data collection and organization to in-depth research on industries and companies, building detailed financial projections, and crafting compelling presentations. For example, an analyst might spend a morning reviewing a companys income statement and balance sheet, comparing current performance against historical data and industry benchmarks. Why is such diligence important? Because every number tells a story, and understanding that story helps identify opportunities or warn of potential pitfalls. When do these activities peak? Often during quarterly and annual reporting seasons, or before major investment decisions are made, when accuracy and speed are paramount. How do they manage this workload? By utilizing specialized software, strong analytical skills, and a methodical approach to problem-solving, ensuring that all aspects of a financial situation are meticulously examined and clearly communicated, fostering a culture of informed decision-making and strategic foresight across the organization.

Where Do Financial Analysts Work? Exploring Diverse Industries

When we ask where does a financial analyst primarily work, the answer reveals a fascinating breadth of opportunities across the financial landscape. Who employs these skilled professionals? Investment banks, hedge funds, private equity firms, mutual funds, corporate finance departments of non-financial companies, insurance companies, and even government agencies all rely heavily on financial analysts. What kind of environments do they find themselves in? From the fast-paced, high-stakes trading floors of Wall Street to the more measured, strategic planning rooms of a Fortune 500 company, or even guiding individual wealth management at boutique firms. Why such a wide range? Because financial analysis is a universal need; every organization that manages money, makes investments, or plans for future growth requires someone to interpret financial data and offer strategic advice. When do these varied roles come into play? Continuously, as financial analysts provide ongoing support for mergers and acquisitions, capital budgeting, risk management, and strategic financial planning across all these sectors. How do they adapt to these diverse settings? By specializing in specific industries or financial products, they tailor their analytical skills to the unique challenges and opportunities presented in each field, ensuring their expertise is relevant and impactful wherever they apply their trade, facilitating a smoother financial journey for their respective organizations and clients.

Specialized Roles: Unpacking Different Types of Financial Analysts

What are the different types of financial analysts, and how do their roles vary, building upon the fundamental question of what does a financial analyst do? You will find investment analysts who focus on public securities, recommending whether to buy, sell, or hold stocks and bonds for clients or funds. Corporate financial analysts, on the other hand, typically work within a companys finance department, helping manage its internal finances, budgeting, and capital allocation decisions. Then there are portfolio managers, who not only analyze but also actively manage investment portfolios for clients. Why do these specializations exist? Because the financial world is vast and complex, requiring deep expertise in specific areas to deliver precise and effective advice. When does one choose a specialization? Often after gaining foundational experience, aligning their skills and interests with a particular segment of finance. How do these roles contribute to the broader financial ecosystem? Each specialization plays a crucial part in optimizing financial performance, managing risk, and driving economic growth, whether by identifying undervalued assets, ensuring a companys financial health, or building robust investment portfolios that meet diverse client objectives, showcasing the multifaceted utility of financial analytical prowess across the entire financial spectrum.

How Do Financial Analysts Make Decisions? The Tools and Techniques

Delving into how a financial analyst actually makes decisions reveals a robust framework built on a combination of analytical tools, deep financial knowledge, and critical thinking. What instruments do they employ? They leverage sophisticated software for data analysis, financial modeling platforms, and extensive databases containing market information, company financials, and economic indicators. Who develops these models and analyzes the output? The analysts themselves, often iterating on models to test various scenarios and assumptions. Why is modeling so central to their work? Because financial models allow them to project future performance, assess potential risks, and calculate valuations, providing a quantitative basis for their recommendations. When are these tools most crucial? During periods of market volatility or when evaluating complex investment opportunities, where small errors can have significant consequences. How do they ensure accuracy and reliability? Through rigorous validation processes, peer review, and continuous learning to stay abreast of the latest analytical techniques and market developments, reinforcing their commitment to delivering precise, evidence-based insights that stand up to scrutiny and drive sound financial judgments in dynamic economic environments.

The Art and Science of Financial Modeling and Valuation

Let us consider the profound importance of financial modeling and valuation, core competencies that truly define what does a financial analyst do. What exactly is financial modeling? It involves constructing abstract representations of financial situations, often using spreadsheets, to predict future outcomes based on various inputs and assumptions. Who uses these models? Everyone from investment bankers valuing a company for a merger to corporate finance professionals forecasting their companys cash flow. Why is valuation so crucial? Because it provides a systematic way to determine the fair economic value of an asset, whether it is a company, a stock, or a project, guiding investment and strategic decisions. When do analysts typically build these models? For virtually every significant financial decision, from capital expenditure planning to assessing a potential acquisition. How do they develop these intricate models? Through a combination of historical data analysis, economic forecasting, and critical judgment about future events, allowing them to create a compelling narrative around the numbers, offering clear direction and justification for proposed financial strategies, helping organizations navigate complexities and seize opportunities with greater confidence and precision.

| Aspect | Description |

|---|---|

| Core Function | Interpreting financial data for actionable insights. |

| Key Skills | Analytical thinking, financial modeling, research, communication. |

| Primary Tools | Spreadsheets (Excel), financial databases, specialized software. |

| Workplaces | Investment banks, corporations, hedge funds, government agencies. |

| Impact | Informing investment decisions, guiding business strategy, managing risk. |

| Goal | Optimizing financial performance and maximizing value. |

Why Is a Financial Analyst Important? Impact on Business and Beyond

Understanding why a financial analyst is so important sheds light on the immense value they bring, truly encapsulating what does a financial analyst do for the broader economy. Who benefits from their expertise? Investors seeking to grow their wealth, companies aiming for sustainable profitability, and even governments making fiscal policy decisions. What is their primary contribution? They act as critical advisors, providing the data-driven rationale needed for strategic planning, resource allocation, and risk management. Why is this contribution indispensable? Because in todays complex and volatile global economy, making uninformed financial decisions can lead to significant losses or missed opportunities. When is their impact most visible? During periods of economic uncertainty, major corporate transformations, or when new investment products emerge, requiring careful evaluation. How do they achieve this widespread influence? By offering clear, unbiased analysis and well-reasoned recommendations that empower decision-makers to act with confidence, fostering greater transparency and efficiency in financial markets, which ultimately contributes to economic stability and growth for all stakeholders involved, from individual savers to multinational corporations.

Driving Strategic Growth: The Analysts Role in Business Success

How do financial analysts actively drive strategic growth, demonstrating another crucial facet of what does a financial analyst do? They are often at the forefront of identifying new market opportunities, evaluating potential mergers and acquisitions, and optimizing a companys capital structure. What does this involve? It means meticulously scrutinizing financial projections for new ventures, assessing the synergy potential of combining companies, and determining the most cost-effective ways for a business to raise funds. Who relies on these insights? Senior management, boards of directors, and potential investors all depend on their thorough analysis to guide major strategic moves. Why is their perspective so valuable? Because they provide a quantitative lens through which to view future possibilities, helping companies make informed bets that can lead to significant expansion and increased shareholder value. When are these strategic analyses most critical? Before any major investment, divestiture, or strategic pivot, when the long-term health and direction of the company are at stake. How do they succeed in this role? Through a blend of sharp analytical skills, deep industry knowledge, and an unwavering commitment to uncovering the truth behind the numbers, ensuring that every strategic decision is built upon a solid foundation of financial intelligence and foresight, preparing organizations to thrive in an ever-evolving marketplace.

Becoming a Financial Analyst: Your Path Forward

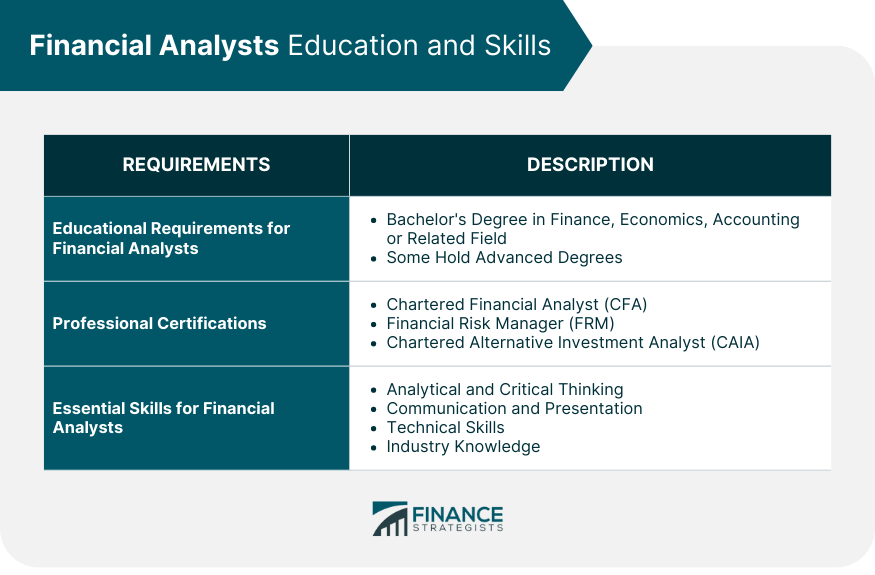

If you are inspired by the question of what does a financial analyst do and feel drawn to this dynamic profession, you might wonder about the path to becoming one. Who typically pursues this career? Individuals with a strong aptitude for numbers, critical thinking skills, and a keen interest in financial markets. What kind of education is usually required? A bachelors degree in finance, economics, accounting, or a related field is a common starting point, with many pursuing advanced degrees like an MBA or certifications such as the CFA (Chartered Financial Analyst) to enhance their credentials and expertise. Why are these qualifications important? They provide the foundational knowledge and analytical frameworks necessary to excel in complex financial roles. When should you start preparing? As early as possible, by focusing on relevant coursework, internships, and networking opportunities. How do you stand out in a competitive field? By developing strong communication skills, proficiency in financial software, and demonstrating an insatiable curiosity about economic trends and business dynamics, you position yourself as a valuable asset, ready to contribute meaningfully to any financial team and embark on a fulfilling and impactful career journey within the world of finance.

Essential Skills for Aspiring Financial Analysts

What are the indispensable skills for anyone aspiring to truly excel, grasping what does a financial analyst do effectively? At the top of the list is strong analytical ability; you must be able to break down complex problems and interpret data efficiently. Who benefits from these skills? Every employer values an analyst who can not only crunch numbers but also understand the story they tell. Why is attention to detail paramount? Because even a small error in a financial model can have significant repercussions on a recommendation or valuation. How do you develop these skills? Through dedicated study, hands-on practice with financial software like Excel, and actively seeking out opportunities to analyze real-world business cases. When do these skills shine brightest? When presenting complex financial information clearly and concisely to non-financial stakeholders, requiring excellent communication and presentation abilities. Furthermore, ethical integrity and a continuous desire to learn are vital, ensuring that analysts operate with the highest standards and stay current with an ever-evolving financial landscape, making them trusted advisors and invaluable members of any team navigating the intricacies of the financial world.

In summary, what does a financial analyst do? A financial analyst interprets vast financial data, advises on investments and business strategy, and optimizes financial performance for diverse organizations, acting as a crucial guide in the complex world of finance.

Keywords: financial analyst, financial analysis, investment, market trends, career, finance jobs, financial modeling, valuation, corporate finance, economic insights.

Financial analysts assess investment opportunities, evaluate company performance, forecast market trends, and advise businesses on financial decisions, crucial for growth and stability.

Financial Career Education Artofit What Is Biometric Types Of Biometrics 2026 Overview What Data Analyst Do What Does A Financial Analyst Do How To Become One Career Sidekick Financial Analyst 5 Steps To Career 768x576

How To Become A Research Analyst A 2026 Guide Coursera GettyImages 1488850354 Payoneer Logo In Transparent PNG Format 43 OFF What Does A Financial Analyst Do What Does A Financial Analyst Do Esential Skills Of A Financial Analyst What Does A Finance Analyst Do Exploring The And What Does A Finance Analyst Do

What Does A Financial Analyst Do Roles Home Thumb 1200 1553 What Does A Financial Analyst Actually Do YouTube What Does A Financial Analyst Do Com YouTube Financial Advisor Vs Financial Analyst 10 Key Differences Geneva Lunch What Does A Financial Analyst Do 1024x536

Financial Vs Management Accounting Differences Explained What Does A Financial Analyst Do What Does An Entry Level Financial Analyst Do Zippia What Does An Entry Level Financial Analyst Do.webpMytehat Blog What Does A Financial Analyst Do Financial Analyst Definition Types Financial Analysts Education And Skills 1

What Does A Financial Analyst Do What Financial Analyst Do What Does A Financial Analyst Do TestGorilla What Does A Financial Analyst Do 01 1 What Does A Financial Analyst Do TestGorilla What Skills Do Financial Analysts Need To Succeed Soft Skills And Cognitive Abilities 1 What Does A Financial Analyst Do Day In Life Financial Analyst

What Does A Financial Analyst Do How To Become One Career Sidekick Financial Analyst Popular Career Specialties 768x576 What Does A Financial Analyst Do FinancialCFA 2026 Exam Details Fees Dates Syllabus Rebi Blogs Images 1.webpWhat Does A Financial Analyst Do Job A Day In The Wall Street Oasis Finance Industry Resources Web Financial Analyst 1

What Does A Financial Analyst Do L The Best Career Guide What Does A Financial Analyst Do What Does A Financial Analyst Do What Does A Financial Analyst Do 711x400 What Does A Financial Analyst Do Beyond The Numbers Rasmussen University What Does A Financial Analyst Do (1)33dce1b4 318b 46de 919b What Does A Financial Analyst Do PDF Financial Analyst Economies 1727567644

What Does A Financial Analysts Do What Is The Average Financial What Does A Financial Analyst Do Explained By 8 Financial Analysts What Does A Financial Analyst Do Cantech Letter What Does A Financial Analyst DoWhat Does A Financial Analyst Do Simple Explanation YouTube

Financial Analyst Complete Career Guide Com What Is A Financial Analyst What Does A Financial Analyst Do What Does A Financial Analyst D01 Test Analyst Duties And At Lori Birdwell Blog En Redesign Career Images 19

33dce1b4-318b-46de-919b-e5934c33130e.png)