Are you a small business owner in the United States wondering how to access crucial resources and support? The SBA guide serves as an invaluable compass, directing entrepreneurs toward funding, counseling, and contracting opportunities that can fundamentally transform their ventures. This comprehensive guide simplifies the often-complex landscape of government assistance, making it approachable for startups and established businesses alike. Understanding the SBA guide empowers you to navigate economic challenges, seize growth opportunities, and build a resilient business. Many are seeking straightforward information on how the Small Business Administration can fuel their success, making this topic highly relevant and trending. This article breaks down who the SBA helps, what services they offer, when you should engage with them, where to find their resources, why their support is critical for national economic health, and how to effectively utilize their extensive network. Prepare to discover practical steps to leverage these essential tools, setting your business on a trajectory toward sustained prosperity and innovation within the American market.

What exactly is the SBA guide and how can it propel your business forward? Imagine having a trusted companion, a roadmap, designed specifically to help small businesses thrive in the dynamic American economy. This is precisely what the SBA guide offers. The Small Business Administration, or SBA, serves as a vital federal agency dedicated to supporting entrepreneurs and small business owners across the United States. Its guide isnt just a document; its a living collection of programs, services, and educational tools tailored to address the diverse needs of businesses at every stage of their journey. From the moment an aspiring entrepreneur dreams of launching a venture to an established company looking to expand, export, or recover from unforeseen challenges, the SBA provides an array of support. We often ask ourselves, what resources are truly available to us, and how do we access them efficiently? The SBA guide answers these questions by detailing everything from securing crucial capital through various loan programs to receiving expert mentorship, and even navigating the complexities of bidding on government contracts. It’s designed to demystify federal aid and make powerful resources accessible, ensuring that the engine of the American economy, its small businesses, continues to run strong and innovate.What Exactly Is the SBA Guide? Navigating Your Small Business Journey

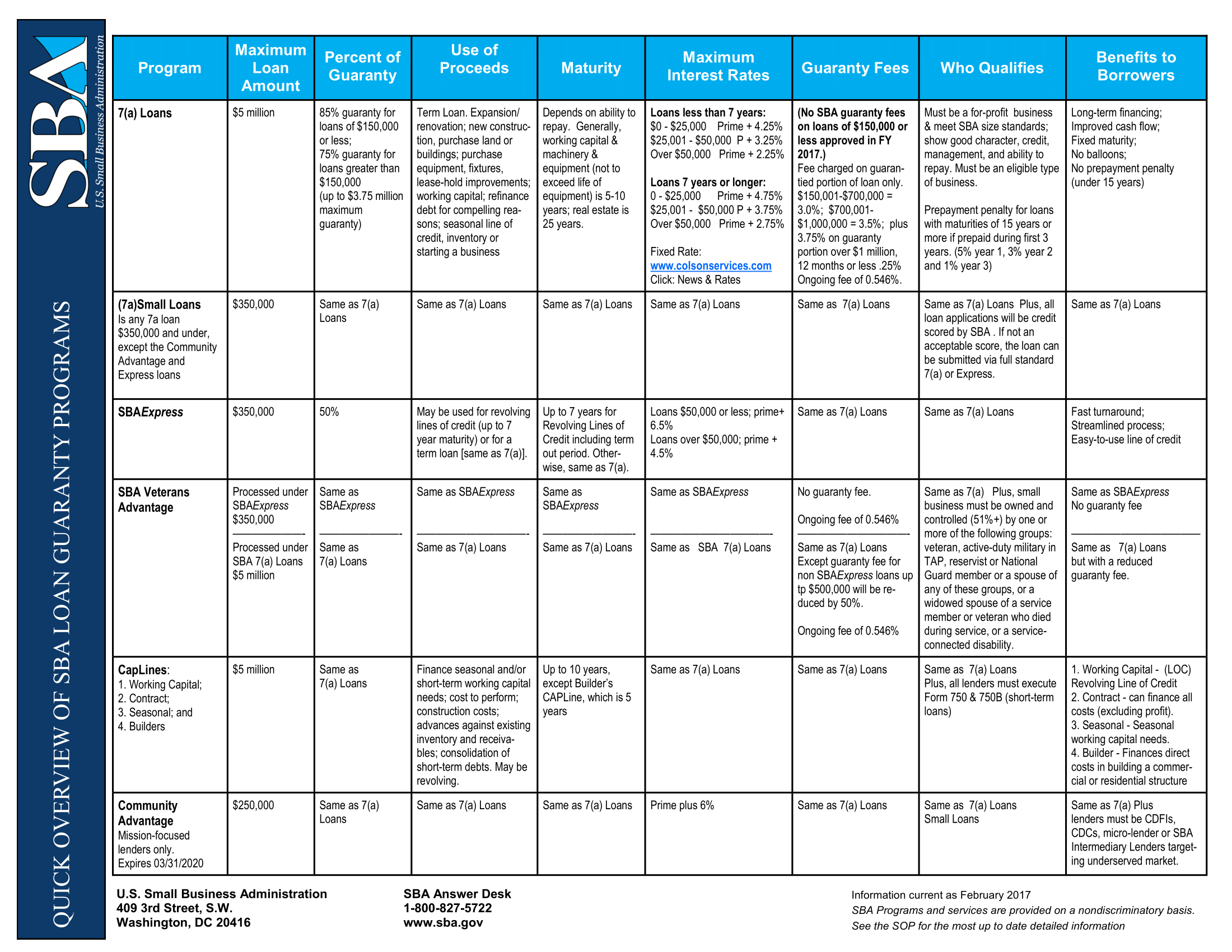

When we talk about the SBA guide, what does it truly encompass, and what value does it bring to daily business operations? The SBA guide functions as a comprehensive portal to understanding the Small Business Administrations mission and how its offerings translate into tangible benefits for you. It clarifies the different branches of support the SBA provides, meticulously outlining each one to prevent any confusion. Think of it as a detailed instruction manual for leveraging federal assistance. For instance, it explains the nuances of the 7(a) loan program, which offers general small business loans, contrasting it with the 504 loan program, specifically designed for real estate and equipment purchases. It also details microloans, perfect for smaller capital needs, and outlines disaster relief loans, a lifeline during unforeseen crises. This guide isnt merely about funding; it delves into the crucial role of business development resources, such as Small Business Development Centers (SBDCs), SCORE mentors, and Womens Business Centers, all offering free or low-cost counseling. It answers the fundamental question of how an entrepreneur, regardless of their experience level, can find direct, actionable support to start, grow, or sustain their business effectively. Why is this guide structured in such a thorough manner? Because the SBA understands that clarity and accessibility are paramount when entrepreneurs are making critical decisions about their business’s future, ensuring no opportunity is missed due to a lack of information.Who Benefits from the SBA Guide? Empowering Entrepreneurs

Who exactly stands to gain the most from consulting the SBA guide, and why is its reach so broad? The beauty of the SBA guide lies in its universal applicability across the small business spectrum. If you are an aspiring entrepreneur sketching out your first business plan, wondering where to find startup capital, this guide is for you. If you own an existing business looking to expand operations, purchase new equipment, or increase working capital, the SBA guide provides a pathway to numerous loan programs and strategic advice. Perhaps your business is facing unexpected challenges, like economic downturns or natural disasters; the guide details specific recovery assistance. Even seasoned business owners aiming to enter the lucrative world of government contracting will find invaluable insights into certifications and bidding processes. The guide is particularly beneficial for underserved communities, including women-owned, veteran-owned, and minority-owned businesses, often providing tailored programs and advocacy. It’s a resource designed for anyone who believes in the power of their small business to contribute to their community and the broader economy, acting as a powerful tool to democratize access to vital support. Why does the SBA focus on such a diverse audience? Because economic strength arises from empowering all entrepreneurs, ensuring everyone has a fair shot at success and innovation.How Does the SBA Guide Assist Small Businesses? Your Blueprint for Success

When we consider how the SBA guide tangibly assists small businesses, what practical steps can an owner take, and what results might they expect? The SBA guide functions as a comprehensive toolkit, providing a multifaceted approach to business assistance. Firstly, it clarifies the often-confusing world of business financing by breaking down various loan options. Need capital to launch a new product? The guide points to specific loan types. Looking to purchase commercial real estate? It details the 504 program. It doesn’t just list loans; it explains the application process, eligibility criteria, and how to prepare a compelling business case for lenders. Secondly, the guide emphasizes the power of expert counseling and mentorship. It outlines how to connect with free business advisors through Small Business Development Centers (SBDCs), offering guidance on everything from marketing strategies to financial management. It also introduces SCORE, a network of retired executives ready to share their decades of experience. Thirdly, for businesses interested in government contracting, the guide unravels the complexities of becoming a federal contractor, detailing certification programs like the 8(a) Business Development program, which helps disadvantaged businesses compete. Lastly, it provides critical information on disaster assistance, ensuring businesses have a safety net during emergencies. Why is this holistic approach so effective? Because successful businesses need more than just money; they require knowledge, strategic partnerships, and resilience, all of which the SBA guide helps foster.Demystifying SBA Loans: A Path to Capital

How do SBA loans work, and what makes them different from traditional bank loans? The SBA guide plays a crucial role in demystifying the world of government-backed financing, making it accessible to entrepreneurs who might otherwise struggle to secure capital. Unlike direct lending from the government, the SBA guarantees a portion of loans made by private lenders, such as banks and credit unions. This guarantee significantly reduces the risk for lenders, making them more willing to provide loans to small businesses that might not meet conventional lending criteria. The guide clearly outlines the most popular programs, such as the 7(a) loan, which serves as the SBA’s primary program for providing financial assistance for a wide range of business purposes, including working capital, equipment purchases, and refinancing debt. It also explains the 504 program, which provides long-term, fixed-rate financing for major fixed assets like real estate and machinery. For those needing smaller amounts, the Microloan program offers loans up to $50,000. Each section of the guide details the maximum loan amounts, typical interest rates, repayment terms, and, crucially, the eligibility requirements, such as business size, use of funds, and ability to repay. Why are these details so important? Because understanding these nuances empowers business owners to select the right loan product, prepare a strong application, and ultimately secure the funding necessary to grow and thrive.Expert Guidance: Unlocking Mentorship and Resources

When navigating the complexities of business ownership, where can entrepreneurs turn for reliable advice, and how does the SBA guide connect them to these vital resources? Beyond financial assistance, the SBA guide champions the power of mentorship and expert guidance, recognizing that knowledge and experience are as valuable as capital. It clearly outlines avenues for free or low-cost business counseling services, ensuring that entrepreneurs are never alone in their journey. The guide introduces readers to Small Business Development Centers (SBDCs), which are partnerships between the SBA and local universities or state governments, offering free, in-depth business consulting, training, and research assistance. These centers provide personalized advice on everything from developing a business plan to navigating marketing strategies and financial forecasting. Additionally, the guide highlights SCORE, a national network of volunteer business mentors, often retired executives, who provide free, confidential business counseling, either in person or online. For women entrepreneurs, the Women’s Business Centers (WBCs) offer specialized support, including training, networking, and access to capital for women-owned businesses. The guide explains how to locate these centers in your area, what services they provide, and how to make the most of your interactions with their advisors. Why is this mentorship so critical? Because it provides entrepreneurs with a sounding board, expert insights, and the confidence to make informed decisions, significantly increasing their chances of long-term success.Why Is the SBA Guide So Important Right Now? Tapping into Current Opportunities

Why has the SBA guide become such a trending and vital resource for small businesses, especially in todays economic climate? The contemporary business landscape in the United States is marked by rapid change, from technological advancements to evolving consumer behaviors and global market shifts. Small businesses continually face new challenges, whether its adapting to digital transformation, managing supply chain disruptions, or navigating inflationary pressures. In this environment, the SBA guide serves as an indispensable tool, providing a stable, reliable source of information and support. Post-pandemic recovery efforts, coupled with initiatives aimed at fostering economic resilience, have placed the SBAs resources front and center. Entrepreneurs are actively seeking avenues for growth, seeking ways to innovate, and needing support to create jobs. The guide addresses these immediate needs by streamlining access to capital for expansion, offering expert advice for strategic pivots, and outlining programs that help businesses compete more effectively, domestically and internationally. Why is this focus on present-day relevance so crucial? Because the SBA continuously adapts its programs to meet current economic realities, making the guide a dynamic and highly practical resource for anyone looking to build a robust and future-proof business in America.When Should You Consult the SBA Guide? Timely Support for Every Stage

When is the optimal time to engage with the SBA guide and its comprehensive suite of resources, and how can its timely application maximize your businesss potential? The simple answer is: at every stage of your business journey. If you are in the foundational phase, just conceptualizing a business idea, the guide offers invaluable insights into business planning, legal structures, and initial funding options. It helps you lay a solid groundwork before you even open your doors. For existing businesses aiming for growth, perhaps by expanding into new markets, launching a new product line, or hiring more staff, the guide details specific loan programs and counseling services designed for expansion. Should your business encounter an unexpected setback, like a natural disaster or a significant economic downturn, the SBA guide provides immediate access to disaster relief programs, offering a crucial lifeline for recovery. Even during periods of steady operation, consulting the guide for information on government contracting or export assistance can uncover new avenues for revenue and market reach. The guide acts as a proactive tool, encouraging entrepreneurs to plan for both success and potential challenges, ensuring they have the knowledge and support network in place before a crisis hits. Why is this continuous engagement so beneficial? Because proactive utilization of the SBAs resources empowers businesses to be more resilient, agile, and poised for sustained success, rather than merely reacting to circumstances.Where Can You Access the SBA Guide and Its Resources? Finding Your Way

When youre ready to dive into the wealth of information provided by the SBA guide, where exactly should you look, and how can you effectively connect with the resources tailored to your specific needs? The primary and most authoritative source for the SBA guide and all its associated resources is the official Small Business Administration website, SBA.gov. This digital hub is meticulously organized, offering dedicated sections for funding, counseling, government contracting, and disaster assistance. You can easily navigate through pages detailing eligibility criteria for various programs, application processes, and success stories. Beyond the website, the SBA maintains a strong physical presence across the United States. They have district offices in every state, where you can find local representatives who understand your regional business landscape and can provide personalized guidance. Furthermore, the SBA partners with numerous local organizations, including Small Business Development Centers (SBDCs), SCORE chapters, and Womens Business Centers (WBCs). These partners provide face-to-face counseling, workshops, and networking opportunities. The guide explains how to use online search tools on the SBA website to locate your nearest district office or resource partner. Why are these multiple access points so crucial? Because the SBA recognizes that entrepreneurs have diverse needs and preferences for how they receive information and support, ensuring that help is always within reach, whether online or in person.| SBA Resource Type | What It Offers | Key Benefit |

|---|---|---|

| SBA Loan Programs | 7(a), 504, Microloans, Disaster Loans | Access to capital for various business needs with government guarantee |

| Business Counseling | SCORE Mentors, SBDCs, Womens Business Centers | Free/low-cost expert advice, training, and strategic guidance |

| Government Contracting | Certifications (8(a), HUBZone, WOSB), Contract Assistance | Opportunities to sell products/services to the federal government |

| Learning Center | Online courses, guides, webinars | Self-paced learning on starting and growing a business |

| Office of Disaster Assistance | Loans for physical and economic damage | Financial aid for recovery after declared disasters |

Accessing SBA funding programs, understanding business counseling, securing government contracts, disaster assistance, SBA loan types (7a, 504, Microloan), finding local SBA resources, eligibility for SBA programs, strategic business planning with SBA support.

Family And Resource Management SBA 3 2024 2026 PDF Information 1710523697SBA Loans Leader Bank Sba Loan Chart 1 Fillable Online And SBA For 2025 2026 Exams Fax Email Large

FY 2026 Budget Official Website Of Arlington County Virginia Government Engagement Analysis For Fy 2026 Budget Page 02 Nominate A Small Business For 2026 SBA Award Saobserver FRM SBA 2 2024 2026 Approved PDF Bleach Hygiene 1CSEC English SBA Guide PDF Human 1710790506

Family And Resource Management SBA 3 2024 2026 PDF Information 12026 NDAA DoD CPARS Changes Coming SmallGovCon Sba Small Business Size Affiliation Rules Vol 2 2025 2026 Program And Budget Handbook Page 14 Fb South African Application Guide 2026 Everything You Need South African Application Guide 2026 Everything You Need To Know

SBA 2026 National Small Business Week Awards Open For Nominations 08202025 SBA NSBW Awards 2048x1152 New SBA Rule Changes Coming In 2026 Cherry Bekaert Article Sbas New Rules 1610552592 X 2 SBA Opens Nominations For 2026 National Small Business Week Awards U SBASEOImage SBA 2025 2026 Twibbonize Og Thumb 1e46fced 7e9c 4101 A647

CSEC SBA 1 Textiles Clothing And Fashion 2024 2026 PDF Textiles 1SBA Publishes 2024 Small Business Resource Guide BDB Martin County 2024 Small Business Resource Guide SBA Cover 2026 English Language SBA Teachers Handbook Pdf Hong Kong Diploma Of 180 DLL FOR GRADE 1 SY 2025 2026 Docx 9acb4527 Thumbnail

Laredo The U S Small Business S 2026 National Small MediaIBDP Curriculum And Subject Choices At SBA 2024 2026 PDF Science 1Family And Resource Management SBA 3 2024 2026 PDF Information 1710588426CSEC SBA 1 Food Nutrition And Health 2024 2026 PDF Hors D Oeuvre 1

Maryland Small Business Center SBDC Helps Maryland Businesses Grow Sba 3120 2019 Sba 2026 PDF Spreadsheet Interest 1716726724Social Studies CSEC SBA Guide PDF 1696053270U S Small Business Houston Annual Small Business SBA Awards 2023

Modules In Social Studies With SBA Guide REVISED BY R Ramsawak S J 1024x1024 CSEC English A SBA Guidelines 2023 PDF Narration Information 1City The SBA 2026 National Small Business Awards Are Now Open Https MediaU S NOW OPEN SBA Is Accepting Nominations For The 2026 National Media

SBA Guidelines Download Free PDF Educational Assessment Teachers 1716922632Business Cognate SBA Guidelines PDF Inquiry Science 1English A SBA GUIDELINES PDF Public Speaking Human 1English A SBA GUIDELINES Pptx Cxcp Lva1 App6892 Thumbnail